There’s a special number created exactly for people with this same issue. It’s called an ITIN, and it allows anyone to fulfill their tax responsibilities in the United States, regardless of immigration status.

If you’ve ever felt confused, scared, or unsure about how to handle taxes without a Social Security number, this guide is for you. Let’s break it down in plain language, step by step.

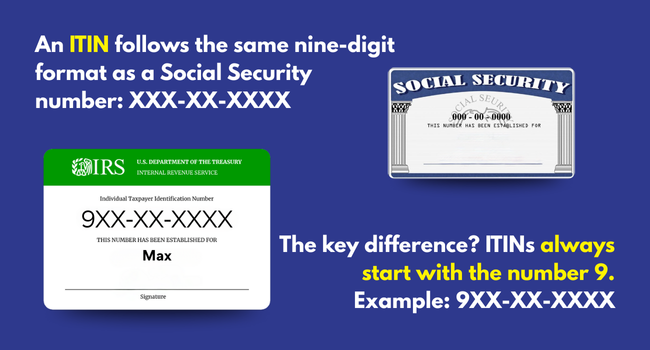

ITIN stands for Individual Taxpayer Identification Number.

Think of it as a special tax ID number that the IRS (Internal Revenue Service) gives to people who need to file taxes but don’t qualify for a Social Security number.

You might need an ITIN if you fall into any of these situations:

If you earn income in the United States—whether from a job, freelance work, or your own small business—you’re required by law to file taxes. An ITIN allows you to do this legally.

Even if you don’t work, you may need an ITIN if:

If you own property, investments, or a business in the U.S., you need an ITIN to report this income to the IRS.

Some visa holders (like L-1 visa holders) and their spouses need ITINs to file U.S. tax returns.

If you’ve spent enough time in the U.S. to be considered a resident for tax purposes but don’t qualify for a Social Security number, you’ll need an ITIN.

Bottom line: If you have a connection to U.S. taxes and don’t have a Social Security number, an ITIN is your legal pathway to staying compliant.

An ITIN is powerful because it allows you to:

Pay your taxes and avoid penalties. This shows you’re following U.S. tax law.

While not all tax benefits are available to ITIN holders (more on this below), you can still claim important credits like:

Filing taxes with an ITIN creates a record that you’re contributing to the U.S. economy. This can be helpful if you later apply for legal status or citizenship.

Some banks and credit unions accept ITINs to open checking and savings accounts.

While more difficult than with a Social Security number, some lenders and financial institutions will work with ITIN holders to build credit history.

Let’s be clear about what an ITIN is NOT:

Having an ITIN doesn’t make you a legal resident or citizen. It’s simply a tax tool.

You cannot use an ITIN to prove you’re allowed to work in the U.S

Even if you pay Social Security taxes using an ITIN, you won’t receive Social Security retirement or disability benefits.

This is one of the biggest tax credits, but it requires a valid Social Security number.

You can’t use your ITIN to board a plane, get a driver’s license, or prove your identity for non-tax purposes.

Not all tax credits are available to everyone, so let’s clarify what you can and cannot claim:

You CAN claim this if:

This credit can be worth up to $2,000 per qualifying child.

You CAN claim up to $500 per dependent if:

You CANNOT claim this credit if:

Gather Your Documents!

You’ll need to prove your identity and foreign status. Acceptable documents include:

Important: You usually need original documents or certified copies from the issuing agency.

Working with a tax pro from Fiesta Auto Insurance offers huge benefits:

No need to risk losing your passport or other vital papers in the mail.

We know the W-7 form inside and out. We make sure everything is filled out correctly the first time to avoid delays.

Fiesta Tax Pros speak Spanish and can explain everything in your preferred language.

Because we verify your documents and submit clean applications, the IRS can process your ITIN request more quickly.

You’ll have someone experienced guiding you through every step of the process.

Your financial well-being starts with understanding your options and taking action. Whether you need an ITIN, tax help, insurance, or just honest answers to your questions, Fiesta Auto Insurance is here for you.

Typical processing time: 7–11 weeks from the date the IRS receives your complete application. During peak tax season (January through April), it can take longer.

Pro tip: Apply as early as possible, especially if you’re planning to file taxes by the April deadline.

The best time to apply for your ITIN is NOW, even if tax season feels far away.

Here’s why:

Filing taxes on time protects you from penalties and shows you’re following the law.

Get access to your money faster with Fiesta Auto Insurance. Our Tax Specialists help MAX-imize your refund and can give you a cash advance in as little as 24 hours!

📍 Locations Across the Nation

💙 Bilingual Service | Servicio Bilingüe

🤝 Community-Trusted

Disclaimer: This blog post provides general information about ITINs and should not be considered legal, tax, or immigration advice. Tax laws change frequently. For personalized guidance, consult with a qualified tax professional or attorney. Fiesta Auto Insurance and Tax Service can connect you with trusted professionals in your area.